Unfortunately, as we are getting closer to 1 January 2021 and the end of the transition period, there is still an absence of clear information / guidance on how Northern Ireland Businesses in particular are to operate post Brexit.

This does not however mean that we as business owners can wait any longer, we need to take responsibility for our business by ensuring that we have done all we can to be ready for Brexit ( in whatever final form that happens).

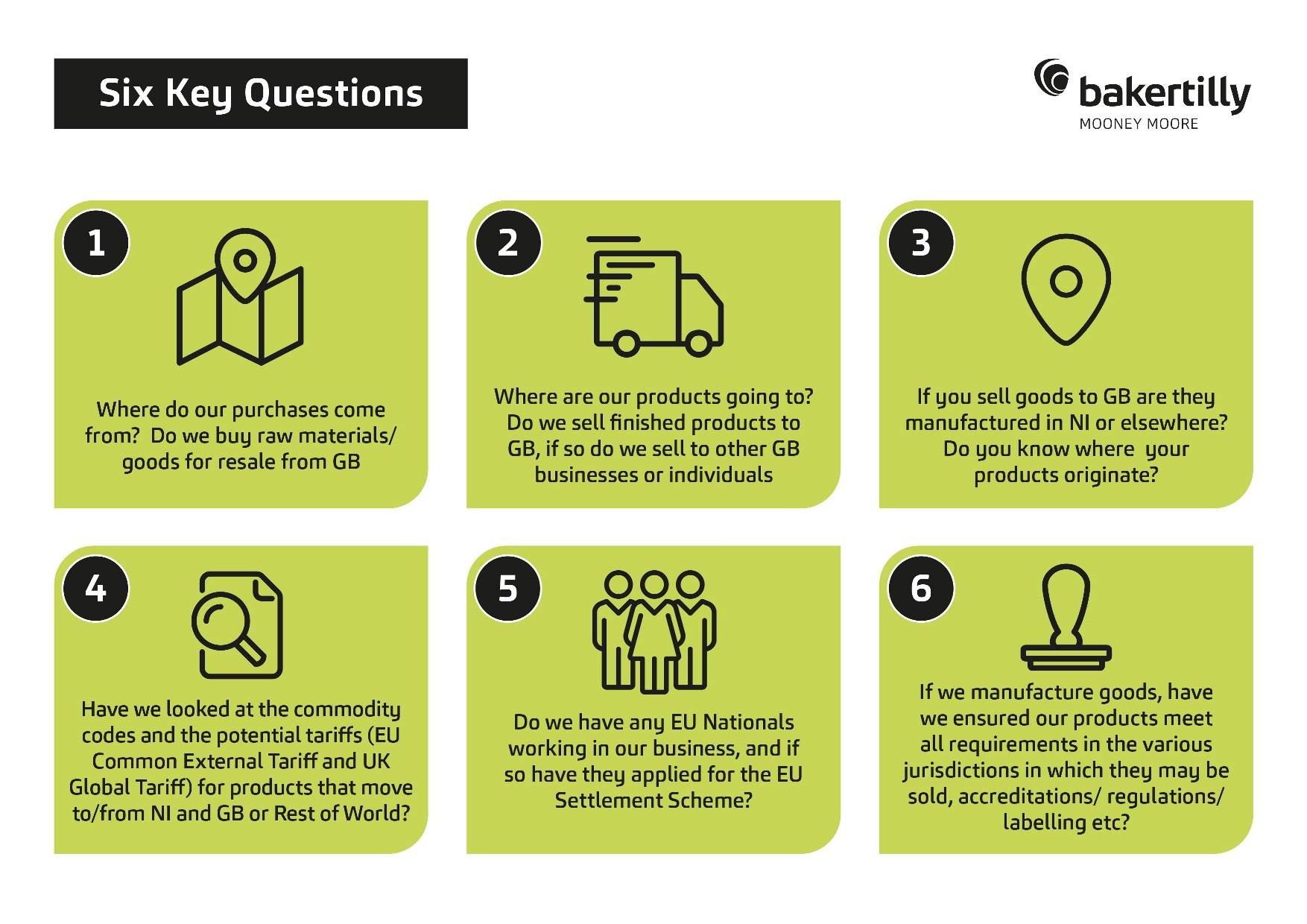

Some of the key questions Norther Ireland businesses should be asking themselves are:

Even with the increasing uncertainty for NI businesses there are a number of steps we can take when we have addressed the questions above, that will help to ensure that we can continue to trade post Brexit. Please see the latest information here.

We are here to help you where needed, and happy to talk through the relevant issues with you, please get in contact with us if you would like to discuss any of the above or your potential Brexit issues and appropriate planning. In addition to working through the above questions there are two simple steps that all businesses should do as soon as possible if relevant.

The EU Settlement Scheme, ensuring that any EU Nationals employed by you have registered for the EU Settlement Scheme, this will give them the right to continue living/ working in UK post Brexit.

https://www.gov.uk/settled-status-eu-citizens-families

The Trader Support Service recently announced by Government will:

- will help if you move goods between Great Britain and Northern Ireland, or bring goods into Northern Ireland from outside the UK

- will be free to use and guide you through any changes to the way goods move between Great Britain and Northern Ireland

- can complete declarations on your behalf

It can help if you:

- are moving the goods yourself

- act on behalf of someone

- send parcels between Great Britain and Northern Ireland, or bring parcels into Northern Ireland from outside the UK, using Royal Mail or an express operator.

Please log onto both of these sites, register your interest in TSS and join the free online training.

Please contact Angela Keery, Tax Director angelakeery@bakertillymm.co.uk or Tel: 028 9032 3466 to find out more.