Are your tax affairs in order, have you minimized your Inheritance Tax liability and ensured your family knows your wishes?

In these uncertain times, people should be looking to the future which includes thinking about health insurance, life insurance, pensions and Inheritance Tax. Most of us want to ensure that our families are protected as far as possible, and that our assets can pass to the family in a tax efficient manner without ultimately having to be sold to pay any Inheritance Tax liability.

We all need to take time out to think about our wishes, and intentions for our families futures, and now is a good time to put in place the appropriate steps to ensure as far as possible our wishes are carried out.

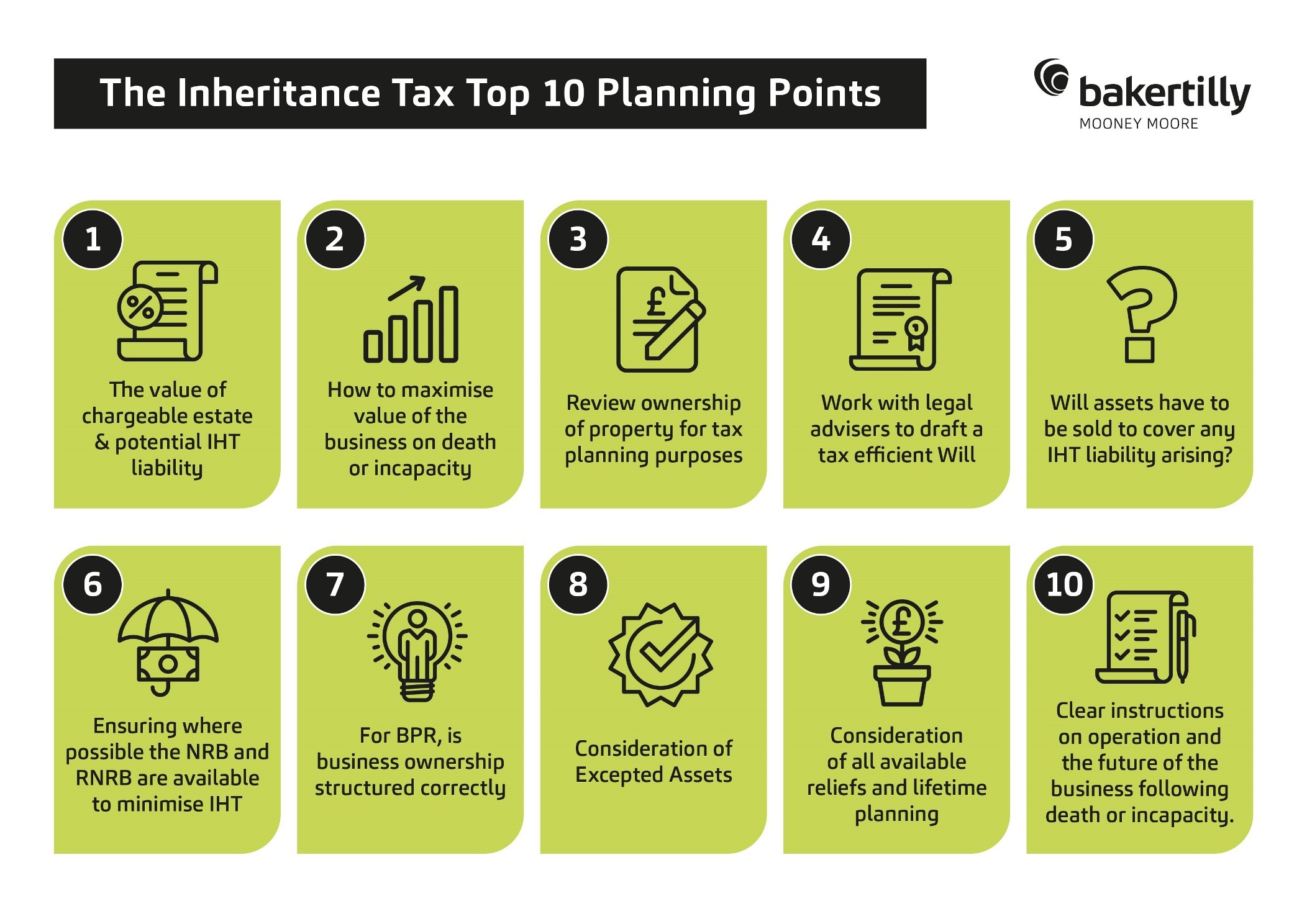

We have significant experience of advising clients on their potential Inheritance Tax position, maximizing reliefs available and assisting them with the specific planning that is required to meet their wishes and intentions. Some of the areas we have been assisting clients with are shown below.

We look forward to working with you on your future plans. Please contact Tax Director Angela Keery by Email angelakeery@bakertillymm.co.uk or Tel: 028 9032 3466 for more.